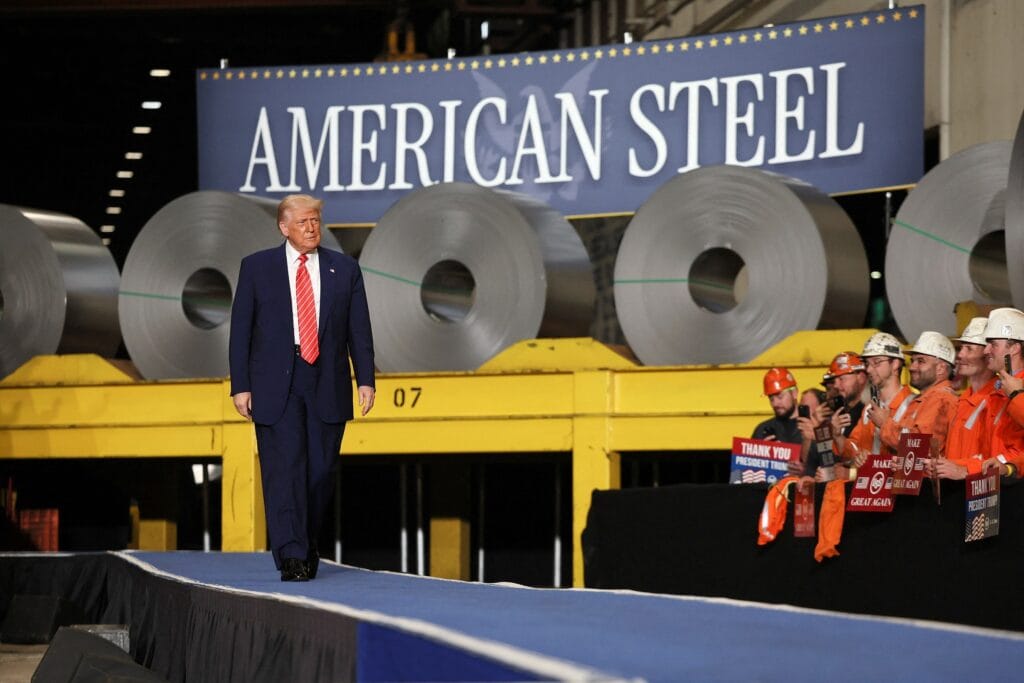

The administration of President Donald Trump has officially doubled import tariffs on steel and aluminum, raising the tax from 25% to 50%. U.S. President Donald Trump explained that this measure is intended to protect the domestic steel and aluminum industries, stating that by raising the tariff to 50%, countries exporting steel to the U.S. will no longer have a chance to “get around it.” While explained as a measure to protect domestic industries, this move has had complex effects, including both short-term benefits and lasting negative consequences.

According to the U.S. Department of Commerce, the U.S. is the world’s largest importer of steel, excluding the European Union (EU), with a total of 26.2 million tons of steel imported in 2024.

Canada is the largest steel exporter to the U.S., with 6.6 million tons last year, followed by Brazil, Mexico, South Korea, and Vietnam. Meanwhile, the Organization for Economic Co-operation and Development (OECD) estimates that the global surplus of steel in 2023 reached 551 million tons, which is four times the production of the EU.

That supply surplus puts pressure on global prices, keeping them too low for U.S. steel producers to operate profitably without tariff protection.

Short-Term Benefits: Revitalizing Domestic Industry

The main goal of this policy is to protect and promote the American steel and aluminum industries. By imposing a 50% tariff, imports become more expensive, giving U.S. producers a competitive price advantage. This has yielded some initial positive results:

- Increased Profitability for Businesses: The stocks of major U.S. steel companies like Nucor and Cleveland-Cliffs surged after the announcement. The price of domestic hot-rolled steel coil also increased sharply, bringing significant profits to producers.

- Stimulated Investment: The policy encourages foreign companies to invest in the U.S. to avoid tariffs. For example, Hyundai Steel is considering building a plant in Louisiana. This not only creates jobs but also strengthens domestic production capacity.

U.S. steel and aluminum producers welcomed the Trump administration’s new tariff measures, stating that the move would block a “wave” of imports.

Mark Duffy, president of the American Primary Aluminum Association, said that for decades, subsidized foreign producers have weakened the domestic manufacturing sector. However, the higher tariffs could increase tensions between Washington and its North American neighbors, who are the largest suppliers of steel imports to the U.S.

Negative Impacts and Consequences of Global Trade Wars

Trade Tensions and the Risk of Trade Wars: The U.S.’s unilateral policy has increased tensions with key trading partners such as Canada, Mexico, and the European Union (EU). These countries view this as a direct attack on their industries and may implement similar retaliatory measures. This not only threatens diplomatic relations but also creates the risk of a global trade war, weakening international trade and destabilizing the world economy.

The Canadian Steel Producers Association (CSPA) warned that the new tariffs would cause major disruptions and negative consequences throughout the Canadian steel supply chain, as well as for customers in both countries.

Meanwhile, the United Steelworkers union, which represents North American steel workers, stated that the tariff increase is a direct attack on Canadian industries and jobs.

The EU also expressed concern about the new U.S. tariff measures. On May 31, a spokesperson for the European Commission (EC) criticized the Trump administration’s decision for increasing global economic instability and raising costs for consumers and businesses on both sides of the Atlantic.

Additionally, the EC warned that the tariff increase also undermines current efforts to reach a negotiated solution. The spokesperson noted that the EU had decided to temporarily suspend its retaliatory measures against U.S. tariff policies for 90 days, from April 14 to July 14, to facilitate negotiations between the EU and the U.S. However, in light of the latest unilateral move by the U.S., the EU is prepared to act to protect its interests.

Meanwhile, on June 2, South Korea’s Ministry of Trade, Industry, and Energy held an emergency meeting with the country’s major steel groups to assess the impact of the new tariffs and to strengthen consultations with the U.S. side to minimize damage to the domestic industry.

In an effort to mitigate the impact of U.S. tariff policies, some South Korean companies plan to increase production in the U.S. The multinational steel group Hyundai Steel plans to invest $5.8 billion to build an electric arc furnace steel mill in Louisiana by 2029. If implemented, this would be the company’s first overseas production facility.

Expert Opinions

Commenting on the U.S. administration’s tariff increase on aluminum and steel imports, experts believe that President Trump wants to support and encourage investment in domestic steel and aluminum production because both are important materials for the construction, transportation, and automotive industries. Higher steel and aluminum prices would increase profits for U.S. producers.

After the tariff increase was announced, the stocks of U.S. steel manufacturers like Nucor and Cleveland-Cliffs rose sharply. The price of hot-rolled steel coil also increased from $780 to $920 per ton, benefiting domestic producers. However, the steel and aluminum industries still face challenges.

Building a metallurgical plant can take five years, or even longer, by the time President Trump’s second term in the White House ends. Electricity costs are another challenge for steel and aluminum production in the U.S. This is the reason for the closure of most metallurgical plants in the U.S., which have struggled to sign long-term, competitive power purchase agreements.

Additionally, experts also commented that the Trump administration’s tariff measures on imported aluminum and steel are like a double-edged sword, where the harm outweighs the benefits. Higher tariffs increase costs for U.S. consumers while weakening manufacturing industries that use these materials.

Analyst Eoin Dinsmore at Goldman Sachs noted that higher aluminum and steel prices are likely to put more pressure on U.S. steel demand from the manufacturing sector, which is already projected to decline this year. The premium for U.S. aluminum buyers has jumped 54%, while the price of U.S. hot-rolled steel coil has increased by 7.4%.

Meanwhile, companies with global supply chains face severe disruption. The tariff increase will raise costs and make it difficult for businesses exporting aluminum and steel to the U.S. to maintain production.

Josh Spoores, Head of Steel Analysis for the Americas at the consulting firm CRU, stated that the U.S. is a net importer of steel and therefore needs imports to meet domestic demand. The tariff increase will not stop imports; it will only raise domestic prices for U.S. steel consumers.

Data from the Institute for Supply Management (ISM) shows that the U.S. manufacturing sector, which is heavily dependent on imported raw materials, declined for the third consecutive month in May, falling to its lowest level in six months as it faced rising costs, affecting profits and employment. U.S. automakers like General Motors and Tesla have reported a decrease in sales due to increased production costs.

In addition, the constant changes in tariffs and their implementation timelines have left many businesses in a state of uncertainty regarding their business planning. Felix Tintelnot, a Professor of Economics at Duke University in North Carolina, questioned how long the 50% tariff would be maintained.

This uncertainty is harming American businesses and impacting workers, despite Trump’s claim that the tariffs would bring great benefits to the U.S. steel industry.

According to the professor, expanding heavy industry capacity typically involves significant initial investments, and no business leader would make a large upfront investment if they don’t believe the policy will remain in effect for many years to come.

While Tintelnot believes the tariff increase will help the steel industry, it also creates difficulties for other U.S. industries. Tintelnot criticized the tariff increase on aluminum and steel as “an ill-informed, economically inconsistent policy that appears to be hiding under national security justifications.”

Overall, President Trump’s increase of the steel tariff to 50%, along with other tariff measures, has had a far-reaching impact, creating tensions in trade relations between the U.S. and partners like Canada, Mexico, and the EU.

While it has brought short-term benefits to the U.S. steel industry, in the long term, this decision could lead to negative consequences for the global economy. Countries may implement retaliatory measures against the U.S., increasing tensions and the risk of a global trade war. Therefore, finding a fair and sustainable trade solution is essential to ensure stable and prosperous development for all involved nations.

According to: Vietnamplus

Related Posts

Vietnamese Lunar New Year A Cultural Beauty That Honors Ancestral Roots And The Sacred New Year’s Eve

HAPPY LUNAR NEW YEAR – VMRF

Repealing the 2009 Endangerment Finding: The First Move in a Long Planned Effort to Rebuild America’s Metallurgical Base

List of Permitted Scrap Imports: A Policy Adjustment to Tighten Environmental Control and Reshape Industrial Raw Material Supply Chains

Tightening Scrap Temporary Import and Re-export: Vietnam Proactively Blocks the Risk of Becoming a Global “Dumping Ground”

Import Policy Trends for Industrial Metal Scrap and Metal-Bearing Waste in Southeast Asia