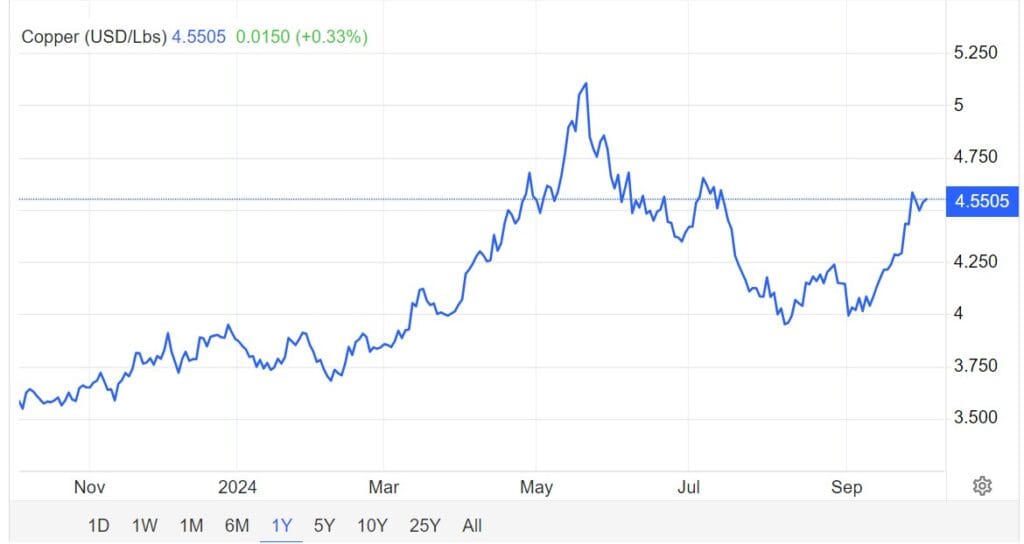

Copper futures steadied around $4.5 per pound on Wednesday after a bout of profit-taking earlier this week, as demand optimism in top consumer China driven by a comprehensive stimulus package continued to support prices. The prospect of further US interest rate cuts which could boost global economic activity also aided sentiment. Over the weekend, China relaxed rules for homebuyers and moved to lower mortgage rates to support the beleaguered property market, signaling a potential rebound in demand for construction materials like copper. The People’s Bank of China also slashed banks’ reserve requirement ratio by 50 basis points last week, which is expected to free up 1 trillion yuan in capital, and lowered key medium- and short-term rates to encourage borrowing and boost liquidity.

Copper futures are widely traded on the London Metal Exchange (LME), at the COMEX and on the Multi-Commodity Exchange in India. The standard contract is 25,000 lbs. Copper is the third most widely used metal in the world. Chile accounts for over one third of world’s copper production followed by Peru, Democratic Republic of the Congo, China, United States, Australia, Indonesia, Zambia, Canada and Poland. The biggest importers of copper are China, Japan, India, South Korea and Germany. Copper market prices displayed in Trading Economics are based on over-the-counter (OTC) and contract for difference (CFD) financial instruments. Our copper market prices are intended to provide you with a reference only, rather than as a basis for making trading decisions. Trading Economics does not verify any data and disclaims any obligation to do so.

| Actual | Previous | Highest | Lowest | Dates | Unit | Frequency |

|---|---|---|---|---|---|---|

| 4.55 | 4.54 | 5.20 | 0.60 | 1988 – 2024 | USd/LB | Daily |

Related Posts

Aluminum recycling in Vietnam: opportunities and challenges

Vietnam has Green Classification Criteria for Investment Projects

History of Pyrolysis Technology Research and Application in Vietnam

VMRF Supporting MRAI – Preparing for IBS 2025 in Vietnam

MRAI Delegation Explores Vietnam’s Metal Recycling Landscape

Extended Producer Responsibility (EPR) in Vietnam. Legal Framework, Implementation, and Stakeholder Engagement